Difference between revisions of "MC2-Project-2"

(→Rubric) |

|||

| (78 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| − | ==Updates== | + | ==Updates/FAQs== |

| + | |||

| + | '''2016/2/29''': | ||

| + | |||

| + | * FAQ and project description overhauled. If you've already started on the project be sure to reread this, some important items have changed. | ||

| + | |||

| + | * Q: Do we show all entry and exit signals or just the ones that are actually relevant for our current positions? For example, if there is an exit signal but we don't hold a position that would be exited yet do we show it on the chart? A: Only show the ones relevant to your current positions. | ||

| + | |||

| + | * Q: Is the IBM price between Dec 2007 and Dec 2009 the only information I have for my strategy? A: You should use only the data available to you in the "/data" directory provided, which is open, high, low, close, adjusted close, and volume. | ||

| + | |||

| + | * Q: Does this mean that we will have a single asset portfolio? and with only 100 (long/short) shares at any given time? A: Yes | ||

| + | |||

| + | * Q: What should we do if there is a buy signal, followed again by a buy signal? A: You should hold one position until exit. So you should ignore the second buy signal. | ||

| + | |||

| + | * Q: Do I have to use the provided data for this project? A: Yes, you must use the provided data. | ||

| + | |||

| + | * Q: Can I use data before Dec 31, 2007? A: No, you can only use data from Dec 31, 2007 to Dec 31, 2009. | ||

| + | |||

| + | * Q: Should we use $SPX or SPY as the benchmark? A: $SPX. | ||

| + | |||

| + | * Q: Regarding part 2 of assignment MC2-P2, do we need to come up with an original idea or can we use a public domain strategy discussed on the internet or published in a book? A: You can use one in the public domain, but be sure to cite the source in your report. | ||

| + | |||

| + | '''2016/3/18''': | ||

| + | |||

| + | * Q: Can we only use IBM price and volume information? A: You can use data available to you in the "/data" directory provided, which also includes other stocks and some ETFs. | ||

| + | |||

| + | * Q: What is the "baseline?" A: That is the performance of the basic Bollinger Band strategy for IBM. | ||

| + | |||

| + | * Q: Are we allowed to implement leverage for this project for part 2 (our strategy)? A: You should only be in a single long or short position of 100 shares of IBM at any one time. If it requires leverage to enter that position, it is OK. | ||

| + | |||

| + | '''2016/3/21''': | ||

| + | |||

| + | * Q: Can we use util.py? A: Yes, you can assume that util.py is available in the directory from which you run your code. If you modify util.py or if you create additional supporting code files, submit them with the rest of your code. We should be able to run your code by placing all of your .py files in a directory and running them. | ||

| + | |||

| + | '''2016/3/22''': | ||

| + | |||

| + | * Q: If I'm determining whether to go long or short on day t, can I use price or volume information from day t+1? A: No, that is "peeking into the future." You can only use information up to the date you are considering to trade. | ||

| + | |||

| + | '''2016/3/25''': | ||

| + | * Q: Should I assess performance from Dec 31, 2007 to Dec 31, 2009? A: Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier. | ||

| + | |||

| + | * Q: How long should our report be? A: Use 11pt font and single spaced lines. We expect that a complete report addressing all the criteria would be at least 3 pages. It should be no longer than 6 pages including charts, tables and text. To encourage conciseness we will deduct 2% for each page over 6 pages. | ||

| + | |||

| + | * Q: Can you clarify which code should create which output? A: | ||

| + | ** bollinger_strategy.py and my_strategy.py should both output | ||

| + | *** A chart including IBM prices, supporting lines illustrating your indicators, and vertical lines indicating entry and exit points. | ||

| + | *** An orders.csv file following the protocol defined in the last project, enumerating entries and exits. | ||

| + | ** Feed the orders file into your marketsim.py code. It should output: | ||

| + | *** A chart illustrating the performance of your strategy versus a benchmark. | ||

| + | *** Statistical analysis of the strategy (e.g., cumulative return, final value, Sharpe ratio, etc.) | ||

==Overview== | ==Overview== | ||

In this project you will develop trading strategies using Technical Analysis, then test them using your market simulator. | In this project you will develop trading strategies using Technical Analysis, then test them using your market simulator. | ||

| − | In this project we shift from an auto graded code format to a report format. For this project your grade will be based on the PDF report you submit. | + | In this project we shift from an auto graded code format to a report format. For this project your grade will be based on the PDF report you submit, not your code. However, you will also submit your code that will be checked visually to ensure it appropriately matches the report you submit. |

==Template== | ==Template== | ||

| − | Create your code within a directory named <tt>ml4t/mc2_p2</tt> . Within that directory you should create | + | Create your code within a directory named <tt>ml4t/mc2_p2/</tt>. Within that directory you should create two python programs as follows: |

| − | * <tt> | + | * <tt>bollinger_strategy.py</tt>: This code should generate a .png chart that illustrates the bollinger bands, and entry and exit points for a bollinger-based strategy. |

| − | + | It should also generate an <tt>orders.csv</tt> file that you feed into your market simulator to backtest the strategy. | |

| − | * <tt> | + | * <tt>my_strategy.py</tt>: This code should generate a .png chart (or charts) that illustrate the clever strategy you develop, along with indications of entry and exit points. It should also generate an <tt>orders.csv</tt> file that you feed into your market simulator to backtest the strategy. |

| − | |||

You will submit all of the above code files along with your PDF report. | You will submit all of the above code files along with your PDF report. | ||

| − | ==Part 1A: Bollinger Band Strategy Chart ( | + | ==Time Period and Stock for Testing== |

| + | |||

| + | We will use IBM and trade it from December 31, 2007 until December 31, 2009. Note that the first trade cannot occur until 20 days after December 31, 2007 because the first value for Bollinger bands is not available until then. | ||

| + | |||

| + | You should evaluate the performance of your strategy from first trade to last trade. The time period of performance will therefor not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier. | ||

| + | |||

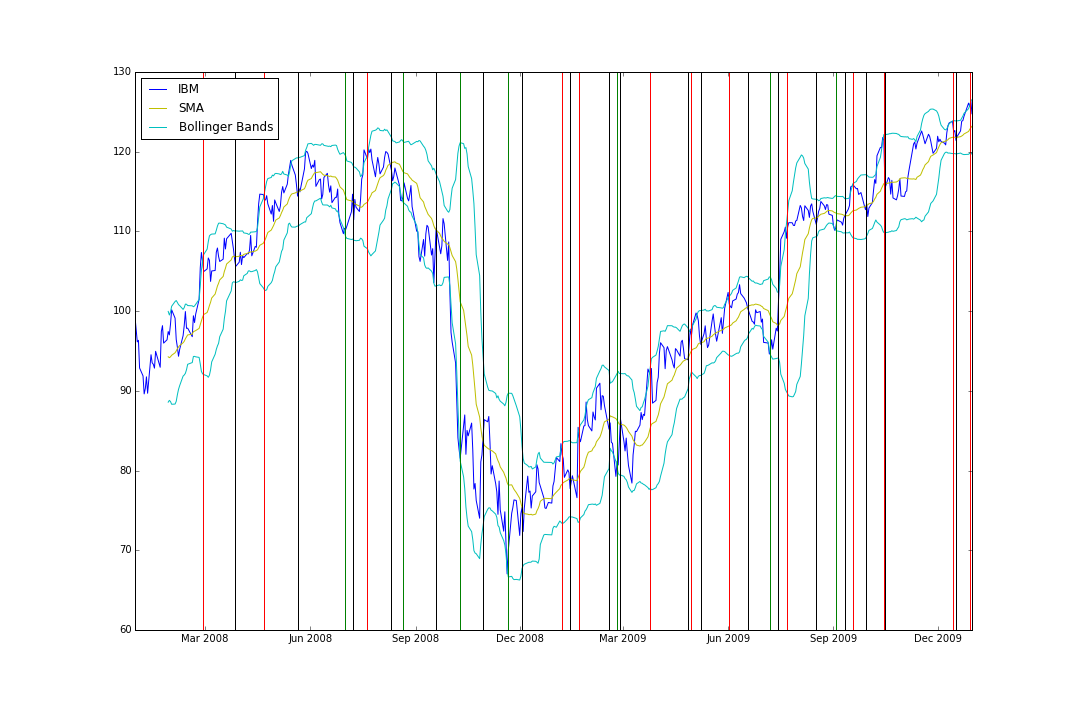

| + | ==Part 1A: Bollinger Band Strategy Chart (15%)== | ||

If you don't know about Bollinger Bands already, go learn about them. Here are some references: | If you don't know about Bollinger Bands already, go learn about them. Here are some references: | ||

| Line 24: | Line 78: | ||

* https://en.wikipedia.org/wiki/Bollinger_Bands | * https://en.wikipedia.org/wiki/Bollinger_Bands | ||

| − | Here are the essential things you need to know and to implement. In addition to the price of a stock over time, Bollinger Bands include: | + | Here are the essential things you need to know and to implement them. In addition to the price of a stock over time, Bollinger Bands include: |

* 20 day simple moving average (SMA) line. | * 20 day simple moving average (SMA) line. | ||

| Line 42: | Line 96: | ||

* Long entries as a vertical green line at the time of entry. | * Long entries as a vertical green line at the time of entry. | ||

* Long exits as a vertical black line at the time of exit. | * Long exits as a vertical black line at the time of exit. | ||

| − | * Short entries as a vertical | + | * Short entries as a vertical RED line at the time of entry. |

* Short exits as a vertical black line at the time of exit. | * Short exits as a vertical black line at the time of exit. | ||

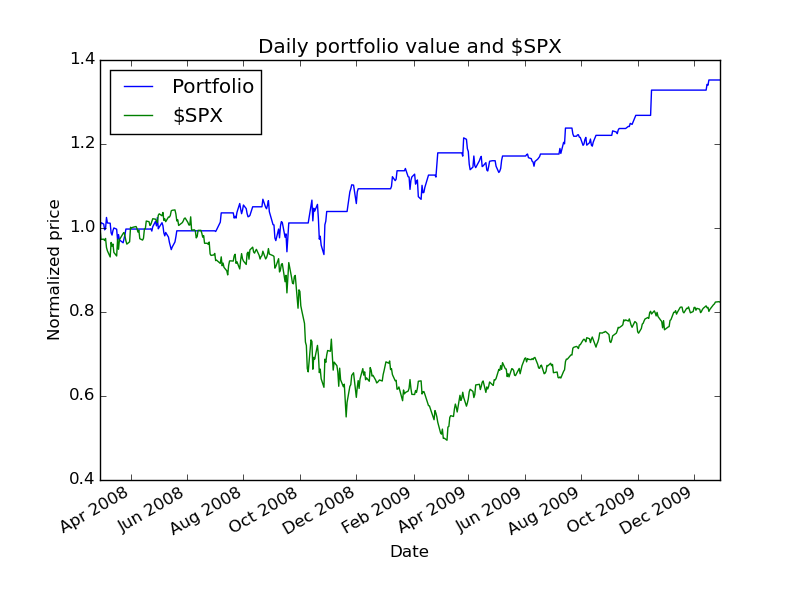

| − | ==Part 1B: Bollinger Band Strategy Backtest ( | + | ==Part 1B: Bollinger Band Strategy Backtest (15%)== |

| − | Reuse your charting code to generate trades | + | Reuse your charting code to generate trades. Start with $10,000. For a long entry, BUY 100 shares and hold until the exit. For a short entry, SELL 100 shares and hold until the exit. Chart the performance of your fund over the time period described in "what to turn in" below. |

| − | + | Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier. | |

| − | + | ==Example Results== | |

| − | + | [[File:bb-entries.png]] | |

| − | + | [[File:bb-strat.png]] | |

| − | + | <pre> | |

| − | + | Data Range: 2008-02-28 00:00:00 to 2009-12-29 00:00:00 | |

| − | |||

| − | + | Sharpe Ratio of Fund: 1.00195922396 | |

| + | Sharpe Ratio of $SPX: -0.116052774605 | ||

| − | + | Cumulative Return of Fund: 0.3524 | |

| + | Cumulative Return of $SPX: -0.176561768835 | ||

| − | + | Standard Deviation of Fund: 0.0113472713465 | |

| − | + | Standard Deviation of $SPX: 0.0225771006222 | |

| − | + | Average Daily Return of Fund: 0.000716211380412 | |

| − | + | Average Daily Return of $SPX: -0.000165053001441 | |

| − | + | Final Portfolio Value: 13524.0 | |

| − | + | </pre> | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | First few trades: | |

<pre> | <pre> | ||

| − | + | 2008-02-28 IBM SELL 100 | |

| − | + | 2008-03-27 IBM BUY 100 | |

| − | + | 2008-04-22 IBM SELL 100 | |

| + | 2008-05-21 IBM BUY 100 | ||

| + | 2008-07-01 IBM BUY 100 | ||

| + | 2008-07-08 IBM SELL 100 | ||

</pre> | </pre> | ||

| − | + | ==Part 2: Your Strategy (60%)== | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | For | + | For this component of the project you are to devise your own Technical Analysis-based signal. Your overall strategy can include Bollinger Bands, but you must devise and code another, separate indicator. You should write code to create a chart that shows relevant information about the indicator, including long and short entry and exit events. Your strategy should outperform the Bollinger Band strategy described above (in terms of cumulative return). You should test your strategy over the same time period as the Bollinger Band example above. |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Important: To ensure a fair comparison of strategies, you should hold only 100 share positions at a time (long or short). Tune your algorithm for the best performance you can find for the in sample period used above. Your report should include an analysis of: | |

| − | + | * In sample performance during the period December 31, 2007 to December 31, 2009. | |

| − | + | * Out of sample performance for the two subsequent years December 31, 2009 to December 31, 2011. | |

| − | + | Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier. | |

| − | |||

| − | + | ==Part 3: Performance (10%)== | |

| − | |||

| − | + | 0 to 10 points will be awarded depending on the performance of your new strategy. See the rubric below for details. | |

| − | |||

| − | + | ==Contents of the Report== | |

| − | |||

| − | + | Submit your report in PDF as <tt>report.pdf</tt>. Use 11pt font and single spaced lines. We expect that a complete report addressing all the criteria would be at least 3 pages. It should be no longer than 6 pages including charts, tables and text. To encourage conciseness we will deduct 2% for each page over 6 pages. Your report should contain the following elements: | |

| − | </ | ||

| − | + | Part 1: | |

| − | + | * Bollinger Band strategy chart showing entry and exit points. | |

| + | * Bollinger Band strategy backtest chart. | ||

| + | * Summary of Bollinger Band backtest performance metrics. | ||

| − | + | Part 2: | |

| − | |||

| − | |||

| − | + | * Written description of your strategy idea. You will be graded on the clarity of your description. It should be sufficiently well described that someone could reproduce your result. | |

| − | + | * Chart or charts that illustrate your strategy idea. At least one of the charts should show entry and exit points. | |

| + | * 2 backtest charts of your strategy: One in sample, the other out of sample. | ||

| + | * Analysis of the performance of your strategy idea over the 2008-2009 period, and separately 2009 to 2011. Note that your strategy should outperform the Bollinger Band strategy in the in sample period. | ||

| + | * Summary of backtest performance metrics, be sure to clearly state the cumulative return for your strategy in sample. | ||

| + | * Your report should address the following questions: | ||

| + | ** What do you think of refining and testing your strategy over the same 2 years? Is that a good practice? Why or why not? Does the strategy continue to work as well out of sample? Why? | ||

| − | + | ==Hints and resources== | |

| − | |||

| − | + | Consider augmenting the Bollinger Band strategy with additional consideration of the SPY's Bollinger values. If the individual stock is substantially different, this could signal an important move for the stock. | |

| − | |||

| − | + | ==What to turn in== | |

| − | + | Be sure to follow these instructions precisely! | |

| − | + | Via T-Square, submit as attachment (no zip files; refer to schedule for deadline): | |

| − | |||

| − | + | * Your code as <tt>bollinger_strategy.py, my_strategy.py</tt> | |

| + | * Your report as <tt>report.pdf</tt> | ||

| − | + | Unlimited resubmissions are allowed up to the deadline for the project. | |

| − | + | ==Rubric== | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | Part 1 (30%): | |

| − | + | * Bollinger Band entry/exit graph correct: 7.5% | |

| + | * Bollinger Band code is correct: 7.5% | ||

| + | * Bollinger Band strategy performance graph correct: 7.5% | ||

| + | * Bollinger Band strategy results correct: 7.5% | ||

| − | + | Part 2 (60%): | |

| + | * Written description of student's strategy is not clear -10% | ||

| + | * Student's strategy code does not match report -40% | ||

| + | * Chart(s) do not illustrate how the student's strategy works -10% | ||

| + | * Backtest charts absent -10% per missing chart. | ||

| + | * Results are not plausible -10% | ||

| + | * Report does not address required questions -10% | ||

| − | + | Part 3 (10%): | |

| − | + | Compare the student's strategy against the baseline of IBM traded according to the basic Bollinger Band strategy implemented in Part 1. | |

| + | If (cumulative return of student's strategy / cumulative return of baseline) is: | ||

| + | * 2.0 or above: 10 points | ||

| + | * Between 1.8 and 2.0: 8 points | ||

| + | * Between 1.6 and 1.8: 6 points | ||

| + | * Between 1.4 and 1.6: 4 points | ||

| + | * Between 1.2 and 1.4: 2 points | ||

| + | * Below 1.2: 0 points | ||

| − | + | Other potential deductions: | |

| − | |||

| − | + | * -2% for each page over 6 pages. | |

| + | * -2% for font smaller than 10pt. | ||

| − | + | ==Required, Allowed & Prohibited== | |

| − | + | Required: | |

| + | * Your project must be coded in Python 2.7.x. | ||

| + | * Code must run (without additional libraries) on one of the university provided computers. | ||

| − | + | Allowed: | |

| + | * You can develop your code on your personal machine, but it must also run successfully on one of the university provided machines or virtual images. | ||

| + | * Your code may use standard Python libraries. | ||

| + | * You may use the NumPy, SciPy, matplotlib and Pandas libraries. Be sure you are using the correct versions. | ||

| + | * You may reuse sections of code (up to 5 lines) that you collected from other students or the internet. | ||

| + | * Code provided by the instructor, or allowed by the instructor to be shared. | ||

| + | * You may copy and use util.py in the local directory. If you modify util.py, be sure to turn it in with your code. | ||

| − | * | + | Prohibited: |

| − | * | + | * Any libraries not listed in the "allowed" section above. |

| − | * | + | * Dead parrots. |

| − | + | * Any code you did not write yourself (except for the 5 line rule in the "allowed" section). | |

Latest revision as of 10:35, 25 March 2016

Contents

- 1 Updates/FAQs

- 2 Overview

- 3 Template

- 4 Time Period and Stock for Testing

- 5 Part 1A: Bollinger Band Strategy Chart (15%)

- 6 Part 1B: Bollinger Band Strategy Backtest (15%)

- 7 Example Results

- 8 Part 2: Your Strategy (60%)

- 9 Part 3: Performance (10%)

- 10 Contents of the Report

- 11 Hints and resources

- 12 What to turn in

- 13 Rubric

- 14 Required, Allowed & Prohibited

Updates/FAQs

2016/2/29:

- FAQ and project description overhauled. If you've already started on the project be sure to reread this, some important items have changed.

- Q: Do we show all entry and exit signals or just the ones that are actually relevant for our current positions? For example, if there is an exit signal but we don't hold a position that would be exited yet do we show it on the chart? A: Only show the ones relevant to your current positions.

- Q: Is the IBM price between Dec 2007 and Dec 2009 the only information I have for my strategy? A: You should use only the data available to you in the "/data" directory provided, which is open, high, low, close, adjusted close, and volume.

- Q: Does this mean that we will have a single asset portfolio? and with only 100 (long/short) shares at any given time? A: Yes

- Q: What should we do if there is a buy signal, followed again by a buy signal? A: You should hold one position until exit. So you should ignore the second buy signal.

- Q: Do I have to use the provided data for this project? A: Yes, you must use the provided data.

- Q: Can I use data before Dec 31, 2007? A: No, you can only use data from Dec 31, 2007 to Dec 31, 2009.

- Q: Should we use $SPX or SPY as the benchmark? A: $SPX.

- Q: Regarding part 2 of assignment MC2-P2, do we need to come up with an original idea or can we use a public domain strategy discussed on the internet or published in a book? A: You can use one in the public domain, but be sure to cite the source in your report.

2016/3/18:

- Q: Can we only use IBM price and volume information? A: You can use data available to you in the "/data" directory provided, which also includes other stocks and some ETFs.

- Q: What is the "baseline?" A: That is the performance of the basic Bollinger Band strategy for IBM.

- Q: Are we allowed to implement leverage for this project for part 2 (our strategy)? A: You should only be in a single long or short position of 100 shares of IBM at any one time. If it requires leverage to enter that position, it is OK.

2016/3/21:

- Q: Can we use util.py? A: Yes, you can assume that util.py is available in the directory from which you run your code. If you modify util.py or if you create additional supporting code files, submit them with the rest of your code. We should be able to run your code by placing all of your .py files in a directory and running them.

2016/3/22:

- Q: If I'm determining whether to go long or short on day t, can I use price or volume information from day t+1? A: No, that is "peeking into the future." You can only use information up to the date you are considering to trade.

2016/3/25:

- Q: Should I assess performance from Dec 31, 2007 to Dec 31, 2009? A: Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier.

- Q: How long should our report be? A: Use 11pt font and single spaced lines. We expect that a complete report addressing all the criteria would be at least 3 pages. It should be no longer than 6 pages including charts, tables and text. To encourage conciseness we will deduct 2% for each page over 6 pages.

- Q: Can you clarify which code should create which output? A:

- bollinger_strategy.py and my_strategy.py should both output

- A chart including IBM prices, supporting lines illustrating your indicators, and vertical lines indicating entry and exit points.

- An orders.csv file following the protocol defined in the last project, enumerating entries and exits.

- Feed the orders file into your marketsim.py code. It should output:

- A chart illustrating the performance of your strategy versus a benchmark.

- Statistical analysis of the strategy (e.g., cumulative return, final value, Sharpe ratio, etc.)

- bollinger_strategy.py and my_strategy.py should both output

Overview

In this project you will develop trading strategies using Technical Analysis, then test them using your market simulator.

In this project we shift from an auto graded code format to a report format. For this project your grade will be based on the PDF report you submit, not your code. However, you will also submit your code that will be checked visually to ensure it appropriately matches the report you submit.

Template

Create your code within a directory named ml4t/mc2_p2/. Within that directory you should create two python programs as follows:

- bollinger_strategy.py: This code should generate a .png chart that illustrates the bollinger bands, and entry and exit points for a bollinger-based strategy.

It should also generate an orders.csv file that you feed into your market simulator to backtest the strategy.

- my_strategy.py: This code should generate a .png chart (or charts) that illustrate the clever strategy you develop, along with indications of entry and exit points. It should also generate an orders.csv file that you feed into your market simulator to backtest the strategy.

You will submit all of the above code files along with your PDF report.

Time Period and Stock for Testing

We will use IBM and trade it from December 31, 2007 until December 31, 2009. Note that the first trade cannot occur until 20 days after December 31, 2007 because the first value for Bollinger bands is not available until then.

You should evaluate the performance of your strategy from first trade to last trade. The time period of performance will therefor not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier.

Part 1A: Bollinger Band Strategy Chart (15%)

If you don't know about Bollinger Bands already, go learn about them. Here are some references:

- http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:bollinger_bands

- https://en.wikipedia.org/wiki/Bollinger_Bands

Here are the essential things you need to know and to implement them. In addition to the price of a stock over time, Bollinger Bands include:

- 20 day simple moving average (SMA) line.

- Upper Band = SMA + 2 * 20 day standard deviation.

- Lower Band = SMA - 2 * 20 day standard deviation.

A basic Bollinger Band trading strategy works as follows: There are two potential entries, long and short. The long entry is made when the price transitions from below the lower band to above the lower band. This indicates that the stock price has moved substantially away from the moving average, but is now moving back towards the moving average. When this entry signal criteria is met, buy the stock and hold it until the exit. The exit signal occurs when the price moves from below the SMA to above it.

The short entry and exit are mirrors of the long entry and exit: The short entry is made when the price transitions from above the upper band to below the upper band. This indicates that the stock price has moved substantially away from the moving average, but is now moving back towards the moving average. When this entry signal criteria is met, short the stock and hold it until the exit. The exit signal occurs when the price moves from above the SMA to below it.

You should create a chart that shows:

- Stock price (adjusted close)

- SMA

- Upper Band

- Lower Band

- Long entries as a vertical green line at the time of entry.

- Long exits as a vertical black line at the time of exit.

- Short entries as a vertical RED line at the time of entry.

- Short exits as a vertical black line at the time of exit.

Part 1B: Bollinger Band Strategy Backtest (15%)

Reuse your charting code to generate trades. Start with $10,000. For a long entry, BUY 100 shares and hold until the exit. For a short entry, SELL 100 shares and hold until the exit. Chart the performance of your fund over the time period described in "what to turn in" below.

Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier.

Example Results

Data Range: 2008-02-28 00:00:00 to 2009-12-29 00:00:00 Sharpe Ratio of Fund: 1.00195922396 Sharpe Ratio of $SPX: -0.116052774605 Cumulative Return of Fund: 0.3524 Cumulative Return of $SPX: -0.176561768835 Standard Deviation of Fund: 0.0113472713465 Standard Deviation of $SPX: 0.0225771006222 Average Daily Return of Fund: 0.000716211380412 Average Daily Return of $SPX: -0.000165053001441 Final Portfolio Value: 13524.0

First few trades:

2008-02-28 IBM SELL 100 2008-03-27 IBM BUY 100 2008-04-22 IBM SELL 100 2008-05-21 IBM BUY 100 2008-07-01 IBM BUY 100 2008-07-08 IBM SELL 100

Part 2: Your Strategy (60%)

For this component of the project you are to devise your own Technical Analysis-based signal. Your overall strategy can include Bollinger Bands, but you must devise and code another, separate indicator. You should write code to create a chart that shows relevant information about the indicator, including long and short entry and exit events. Your strategy should outperform the Bollinger Band strategy described above (in terms of cumulative return). You should test your strategy over the same time period as the Bollinger Band example above.

Important: To ensure a fair comparison of strategies, you should hold only 100 share positions at a time (long or short). Tune your algorithm for the best performance you can find for the in sample period used above. Your report should include an analysis of:

- In sample performance during the period December 31, 2007 to December 31, 2009.

- Out of sample performance for the two subsequent years December 31, 2009 to December 31, 2011.

Feed the orders into your market simulator and assess it over the period from first trade to last trade only. The time period of performance will therefore not exactly match Dec 31, 2007 to Dec 31 2009. It will probably start later and end earlier.

Part 3: Performance (10%)

0 to 10 points will be awarded depending on the performance of your new strategy. See the rubric below for details.

Contents of the Report

Submit your report in PDF as report.pdf. Use 11pt font and single spaced lines. We expect that a complete report addressing all the criteria would be at least 3 pages. It should be no longer than 6 pages including charts, tables and text. To encourage conciseness we will deduct 2% for each page over 6 pages. Your report should contain the following elements:

Part 1:

- Bollinger Band strategy chart showing entry and exit points.

- Bollinger Band strategy backtest chart.

- Summary of Bollinger Band backtest performance metrics.

Part 2:

- Written description of your strategy idea. You will be graded on the clarity of your description. It should be sufficiently well described that someone could reproduce your result.

- Chart or charts that illustrate your strategy idea. At least one of the charts should show entry and exit points.

- 2 backtest charts of your strategy: One in sample, the other out of sample.

- Analysis of the performance of your strategy idea over the 2008-2009 period, and separately 2009 to 2011. Note that your strategy should outperform the Bollinger Band strategy in the in sample period.

- Summary of backtest performance metrics, be sure to clearly state the cumulative return for your strategy in sample.

- Your report should address the following questions:

- What do you think of refining and testing your strategy over the same 2 years? Is that a good practice? Why or why not? Does the strategy continue to work as well out of sample? Why?

Hints and resources

Consider augmenting the Bollinger Band strategy with additional consideration of the SPY's Bollinger values. If the individual stock is substantially different, this could signal an important move for the stock.

What to turn in

Be sure to follow these instructions precisely!

Via T-Square, submit as attachment (no zip files; refer to schedule for deadline):

- Your code as bollinger_strategy.py, my_strategy.py

- Your report as report.pdf

Unlimited resubmissions are allowed up to the deadline for the project.

Rubric

Part 1 (30%):

- Bollinger Band entry/exit graph correct: 7.5%

- Bollinger Band code is correct: 7.5%

- Bollinger Band strategy performance graph correct: 7.5%

- Bollinger Band strategy results correct: 7.5%

Part 2 (60%):

- Written description of student's strategy is not clear -10%

- Student's strategy code does not match report -40%

- Chart(s) do not illustrate how the student's strategy works -10%

- Backtest charts absent -10% per missing chart.

- Results are not plausible -10%

- Report does not address required questions -10%

Part 3 (10%):

Compare the student's strategy against the baseline of IBM traded according to the basic Bollinger Band strategy implemented in Part 1. If (cumulative return of student's strategy / cumulative return of baseline) is:

- 2.0 or above: 10 points

- Between 1.8 and 2.0: 8 points

- Between 1.6 and 1.8: 6 points

- Between 1.4 and 1.6: 4 points

- Between 1.2 and 1.4: 2 points

- Below 1.2: 0 points

Other potential deductions:

- -2% for each page over 6 pages.

- -2% for font smaller than 10pt.

Required, Allowed & Prohibited

Required:

- Your project must be coded in Python 2.7.x.

- Code must run (without additional libraries) on one of the university provided computers.

Allowed:

- You can develop your code on your personal machine, but it must also run successfully on one of the university provided machines or virtual images.

- Your code may use standard Python libraries.

- You may use the NumPy, SciPy, matplotlib and Pandas libraries. Be sure you are using the correct versions.

- You may reuse sections of code (up to 5 lines) that you collected from other students or the internet.

- Code provided by the instructor, or allowed by the instructor to be shared.

- You may copy and use util.py in the local directory. If you modify util.py, be sure to turn it in with your code.

Prohibited:

- Any libraries not listed in the "allowed" section above.

- Dead parrots.

- Any code you did not write yourself (except for the 5 line rule in the "allowed" section).