Difference between revisions of "MC1-Project-1"

(→Task) |

|||

| Line 11: | Line 11: | ||

You are given the following inputs for analyzing a portfolio: | You are given the following inputs for analyzing a portfolio: | ||

* A date range to select the historical data to use (specified by a start and end date) | * A date range to select the historical data to use (specified by a start and end date) | ||

| − | * Symbols for equities (e.g., GOOG, AAPL, GLD, XOM) | + | * Symbols for equities (e.g., GOOG, AAPL, GLD, XOM). Note: You should support any symbol in the data directory. |

| − | * Allocations to the equities at the beginning of the simulation (e.g., 0.2, 0.3, 0.4, 0.1) | + | * Allocations to the equities at the beginning of the simulation (e.g., 0.2, 0.3, 0.4, 0.1), should sum to 1.0. |

* Total starting value of the portfolio (e.g. $1,000,000) | * Total starting value of the portfolio (e.g. $1,000,000) | ||

| Line 20: | Line 20: | ||

* Standard deviation of daily returns | * Standard deviation of daily returns | ||

* Sharpe ratio of the overall portfolio, given daily risk free rate (usually 0), and yearly sampling frequency (usually 252, the no. of trading days in a year) | * Sharpe ratio of the overall portfolio, given daily risk free rate (usually 0), and yearly sampling frequency (usually 252, the no. of trading days in a year) | ||

| + | * Ending value of the portfolio | ||

| − | Your program will include a helper function to specify the portfolio data, then your function should calculate and return the portfolio statistics. Be sure to include all necessary code in your submitted Python | + | Your program will include a helper function to specify the portfolio data, then your function should calculate and return the portfolio statistics. Be sure to include all necessary code in your single submitted Python file. For grading purposes, we will test ONLY the function that computes statistics. You should implement the following API EXACTLY, if you do not your submission will be penalized at least 20%. |

<PRE> | <PRE> | ||

Revision as of 15:39, 25 November 2015

Contents

Overview

A portfolio is a collection of stocks (or other investment options) and corresponding allocations of money to each of them. In order to evaluate and compare different portfolios, we first need to compute certain metrics, based on available historical data.

The primary goal of this assignment is to introduce you to this form of portfolio analysis. You will use pandas for reading in data, calculating various statistics and plotting a comparison graph.

An older version of this assignment: MC1-Project-1-archive

Task

You are given the following inputs for analyzing a portfolio:

- A date range to select the historical data to use (specified by a start and end date)

- Symbols for equities (e.g., GOOG, AAPL, GLD, XOM). Note: You should support any symbol in the data directory.

- Allocations to the equities at the beginning of the simulation (e.g., 0.2, 0.3, 0.4, 0.1), should sum to 1.0.

- Total starting value of the portfolio (e.g. $1,000,000)

Your goal is to compute the daily portfolio value over given date range, and then the following statistics for the overall portfolio:

- Cumulative return

- Average daily return

- Standard deviation of daily returns

- Sharpe ratio of the overall portfolio, given daily risk free rate (usually 0), and yearly sampling frequency (usually 252, the no. of trading days in a year)

- Ending value of the portfolio

Your program will include a helper function to specify the portfolio data, then your function should calculate and return the portfolio statistics. Be sure to include all necessary code in your single submitted Python file. For grading purposes, we will test ONLY the function that computes statistics. You should implement the following API EXACTLY, if you do not your submission will be penalized at least 20%.

import datetime as dt

cr, adr, sddr, sr, ev = \

assess_portfolio(sd=dt.datetime(2008,1,1), ed=dt.datetime(2009,1,1), \

syms=['GOOG','AAPL','GLD','XOM'], \

allocs=[0.1,0.2,0.3,0.4], \

sv=1000000, rfr=0, sf=252)

Where the returned outputs are:

- cr: Cumulative return

- adr: Average daily return

- sddr: Standard deviation of daily return

- ev: End value of portfolio

The input parameters are:

- sd: A datetime object that represents the start date

- ed: A datetime object that represents the end date

- syms: A list of symbols that make up the portfolio (note that your code should support any symbol in the data directory)

- allocs: A list of allocations to the stocks, must sum to 1.0

- sv: Start value of the portfolio

- rfr: The risk free rate for the entire period

- sf: Sampling frequency per year

Template

A template is provided for you to get started with the project: mc1_p1.zip

Download and unzip it inside ml4t/. It should consist of:

- mc1_p1/: Root directory for the template

- portfolio/: Python package with all project-specific code

- analysis.py: Main project script with functions you need to implement, as well as test code

- output/: Directory to store all program outputs, including plots

- util.py: Utility functions (do not modify these, unless instructed)

- portfolio/: Python package with all project-specific code

You should change ONLY analysis.py. ALL of your code should be in that one file. Do not create additional files. It should always remain in and run from the directory ml4t/mc1_p1/portfolio. If you move it somewhere else and develop your code there, it may not run properly when auto graded.

Notes:

- Ignore any file named __init__.py; they are used to mark directories as Python packages.

- We assume your data/ directory is one level up, (i.e., ../data/). That directory should contain all stock data, in CSV files (e.g. GOOG.csv, AAPL.csv, etc.)

- To execute the main script, make sure your current working directory is mc1_p1/, then run:

python -m portfolio.analysis

This directory structure may seem a little complicated at first, but it will help you organize your code better.

Instructions

- Open: portfolio/analysis.py

Function documentation and code comments should help you understand what you need to do. If it is still not clear, read the detailed instructions below. - Look at the function: test_run()

Here we have set up some sample inputs, which are then passed to the assess_portfolio() function:

start_date = '2010-01-01' end_date = '2010-12-31' symbols = ['GOOG', 'AAPL', 'GLD', 'XOM'] allocs = [0.2, 0.3, 0.4, 0.1] start_val = 1000000 assess_portfolio(start_date, end_date, symbols, allocs, start_val)

- Now look at: assess_portfolio()

It first reads historical data for the given date range and symbols, and then uses three helper functions to simulate and assess the performance of the stock portfolio. assess_portfolio() is a helper function that is used to exercise your code. It will NOT be evaluated in the grading process.

- Your job is to implement these functions, with EXACTLY the APIs (inputs and outputs) described below. DO NOT modify the list of input parameters or output results because they will be tested by the auto grading system:

- get_portfolio_value(prices, allocs, start_val): Compute daily portfolio value given stock prices, allocations and starting value.

Ensure that it returns a pandas Series or DataFrame (with a single column). - get_portfolio_stats(port_val, daily_rf, samples_per_year): Calculate statistics on daily portfolio value, given daily risk-free rate and data sampling frequency.

This function should return a tuple consisting of the following statistics (in order): cumulative return, average daily return, standard deviation of daily return, Sharpe ratio

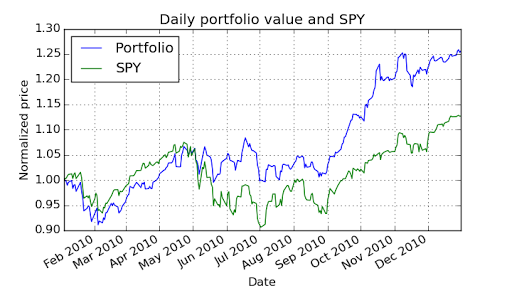

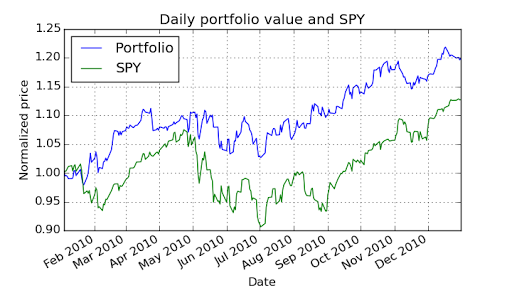

Note: The return statement provided ensures this order. - plot_normalized_data(df, title, xlabel, ylabel): Normalize given stock prices and plot for comparison.

This is used to create a chart that illustrates the value of your portfolio over the year and compares it to SPY.

Note: Before plotting, portfolio and SPY values should be normalized to 1.0 at the beginning of the period. Also, use the plot_data() utility function to generate and show your plot.

- get_portfolio_value(prices, allocs, start_val): Compute daily portfolio value given stock prices, allocations and starting value.

- Refer to each function's documentation (in triple quotes after the def line) for details about the parameters and expected return values.

- Implement each function; feel free to modify test_run() and assess_portfolio() to write additional tests (e.g. to call and inspect the functions individually).

- Save the comparison plot as comparison.png (you should be able to do this directly from the plot window).

- Submit your final analysis.py along with comparison.png once you are confident that your functions are working as expected.

Note: In order to avoid issues with grading, make sure your functions accept exactly the parameters and return the value(s) that are defined in the respective function documentation. Also, turn off all printing and plotting from within these functions, unless instructed (e.g. plot_normalized_data() should generate a plot).

Suggestions

Here is a suggested high-level outline for what your script needs to do:

- Read in adjusted closing prices for the 4 equities.

- Normalize the prices according to the first day. The first row for each stock should have a value of 1.0 at this point.

- Multiply each column by the allocation to the corresponding equity.

- Multiply these normalized allocations by starting value of overall portfolio, to get position values.

- Sum each row (i.e. all position values for each day). That is your daily portfolio value.

- Compute statistics from the total portfolio value.

Here are some notes and assumptions:

- When we compute statistics on the portfolio value, we do not include the first day.

- We assume you are using the data provided. If you use other data your results may turn out different from ours. Yahoo's online data changes every day. We could not build a consistent "correct" answer based on "live" Yahoo data.

- Assume 252 trading days/year.

Make sure your assess_portfolio() function gives correct output. Check it against the examples below.

Example output

These are actual correct examples that you can use to check your work.

Example 1

Start Date: 2010-01-01 End Date: 2010-12-31 Symbols: ['GOOG', 'AAPL', 'GLD', 'XOM'] Allocations: [0.2, 0.3, 0.4, 0.1] Sharpe Ratio: 1.51819243641 Volatility (stdev of daily returns): 0.0100104028 Average Daily Return: 0.000957366234238 Cumulative Return: 0.255646784534

Example 2

Start Date: 2010-01-01 End Date: 2010-12-31 Symbols: ['AXP', 'HPQ', 'IBM', 'HNZ'] Allocations: [0.0, 0.0, 0.0, 1.0] Sharpe Ratio: 1.30798398744 Volatility (stdev of daily returns): 0.00926153128768 Average Daily Return: 0.000763106152672 Cumulative Return: 0.198105963655

Example 3

Start Date: 2010-06-01 End Date: 2010-12-31 Symbols: ['GOOG', 'AAPL', 'GLD', 'XOM'] Allocations: [0.2, 0.3, 0.4, 0.1] Sharpe Ratio: 2.21259766672 Volatility (stdev of daily returns): 0.00929734619707 Average Daily Return: 0.00129586924366 Cumulative Return: 0.205113938792

What to turn in

Be sure to follow these instructions diligently!

Submit via T-Square as attachments only (no zip files please):

- Your code as analysis.py (please use this EXACT filename)

- Your plot of daily portfolio value versus SPY as comparison.png (use EXACT filename)

The plot should be generated using the following:, Start Date: 2010-01-01, End Date: 2010-12-31, Symbols: ['GOOG', 'AAPL', 'GLD', 'XOM'], Allocations: [0.2, 0.2, 0.4, 0.2]

Unlimited resubmissions are allowed up to the deadline for the project.

Rubric

- Part 1: Chart is correct

- Normalized values start at 1.0 on left (10%)

- Shape of curves are correct (10%)

- Part 2: 10 test cases: We will test your code against 10 cases (8% per case). Each case will be deemed "correct" if:

- Sharpe ratio = reference answer +- 0.001

- Average daily return = reference answer +- 0.00001

- Cumulative return = reference answer +- 0.001

Required, Allowed & Prohibited

Required:

- Your project must be coded in Python 2.7.x.

- Your code must run on one of the university-provided computers (e.g. buffet02.cc.gatech.edu), or on one of the provided virtual images.

- Your code must run in less than 5 seconds on one of the university-provided computers.

Allowed:

- You can develop your code on your personal machine, but it must also run successfully on one of the university provided machines or virtual images.

- Your code may use standard Python libraries.

- You may use the NumPy, SciPy and Pandas libraries.

- Small sections of code (up to 5 lines) that you collected from other students or the internet.

- Code provided by the instructor, or allowed by the instructor to be shared.

Prohibited:

- Any libraries not listed in the "allowed" section above.

- Any code you did not write yourself (except for the 5 line rule in the "allowed" section).

- Any Classes other than Random that create their own instance variables for later use (e.g., learners like kdtree).